An S corporation should report expenses paid this year with proceeds from PPP loans that were forgiven this year in column (d) on line 5 of the Schedule M-2. On the first day of the corporation’s first tax year as an S corporation, the balance of the AAA is zero. At the end of the tax year, adjust the AAA for the items as explained below and in the order listed.

- Don’t include amounts paid or incurred for fringe benefits of officers and employees owning 2% or less of the corporation’s stock.

- However, to figure its net investment income, the active shareholder needs certain information from the corporation.

- The deduction is subject to recapture under section 1245 if the election is voluntarily revoked or the production fails to meet the requirements for the deduction.

- For an individual shareholder, enter the shareholder’s social security number (SSN) or individual taxpayer identification number (ITIN) in item E.

- To do so, the corporation must generally treat the gain allocable to each installment payment as unrecaptured section 1250 gain until all such gain has been used in full.

This deduction is available to S corporations with pass-through income from a qualified trade or business and can help reduce the tax burden on shareholders. Schedule J is where you’ll calculate the corporation’s tax liability. You’ll start by multiplying the taxable income calculated on Page 1 by the corporate tax rate.

Overall, understanding the various components of these forms and the implications for tax and payments can confuse many taxpayers, leading to common issues and questions in this area. Form 1120S is a tax document used by S corporations to report the income, deductions, and credits of the business. It is also used to report the shareholders’ pro rata share of income, deductions, and credits. Essentially, Form 1120S is the entity’s tax return, and it provides the IRS with a detailed overview of the corporation’s financial activities. This includes the pro rata share of W-2 wages and UBIA of qualified property reported to the S corporation from any qualified trades or businesses of an RPE the S corporation owns directly or indirectly.

Real Estate and Rental and Leasing

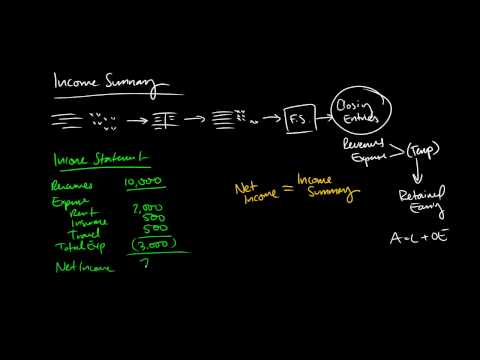

Schedule M-2 is used to analyze a corporation’s unappropriated retained earnings per its books. Company boards can set aside company earnings for a specific purpose. Retained earnings that aren’t allocated for a specific purpose — unappropriated retained earnings — can be paid out to shareholders as dividends. Schedule M-2 starts with retained earnings at the beginning of the year, adds net income and subtracts why project accounting guides project success distributions.

Support activities for agriculture and forestry

Include any other type of income (loss) not reported using codes A through S. Report each shareholder’s pro rata share of the collectibles (28%) gain (loss) in box 8b of Schedule K-1. Figure the amount attributable to collectibles from the amount reported on Schedule D (Form 1120-S), line 15. A collectibles gain (loss) is any long-term gain or deductible long-term loss from the sale or exchange of a collectible that is a capital asset. An annual PTEP account of the S corporation is different than the shareholders’ undistributed taxable income previously taxed account, as discussed in the instructions to Schedule M-2, column (b).

What are the 2020 standard deduction amounts?

The limitation on business interest expense under section 163(j) applies to every taxpayer with a trade or business, unless the taxpayer meets certain specified exceptions. A taxpayer may elect out of the limitation for certain businesses otherwise subject to the business interest expense limitation. Prepaid farm supplies include expenses for feed, seed, fertilizer, and similar farm supplies not used or consumed during the year. Section 464(d) limits the deduction for certain expenditures of S corporations engaged in farming if they use the cash method of accounting, and their prepaid farm supplies are more than 50% of other deductible farming expenses.

Also see the requirement for an attached statement in the instructions for line 15f. Complete Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuels Credit. Include any amount from line 10 of Form 8864 in the corporation’s income on line 5 of Form 1120-S. Also report separately on an attached statement the amount of any sustainable aviation fuel credit. Report each shareholder’s pro rata share of charitable contributions in box 12 of Schedule K-1 using codes A through G for each of the contribution categories shown earlier.

Shareholders who dispose of stock are treated as shareholders for the day of their disposition. Shareholders who net operating profit after tax definition die are treated as shareholders for the day of their death. Each shareholder’s information must be on a separate sheet of paper. Therefore, separate all continuously printed substitutes before you file them with the IRS. The S corporation must answer “Yes” or “No” by checking the appropriate box. Maximum percentage owned in partnership profit, loss, or capital.

S corporations must also distribute Schedule K-1, which reports each shareholder’s share of income, deductions, and credits, to their shareholders by the deadline. Shareholders should include this information on their individual the entries for closing a revenue account in a perpetual inventory system chron com tax returns and make any necessary tax payments by the appropriate deadlines. Schedule K-1 is a crucial form for shareholders of S corporations as it outlines their share of the corporation’s income, deductions, and credits. This information is essential for shareholders to report their personal tax returns accurately.